Help Isom IGA recover from devasting floods

For most grocers, this is a period of amazing sales growth. With restaurants closed or offering limited services in many markets and shoppers afraid of going out to eat, we are enjoying the single biggest reversal in eat-at-home trends in the last 20 years.

What makes current times so unusual is that the sales growth we have enjoyed came to us because shoppers either had to return to home-served meals, or because they were afraid of eating out. As retailers, its great to see such growth on the top line, but it feels strange, too—we aren’t earning share as much as receiving it. And for retailers who are used to promoting and activating to drive sales, these times create this little voice in the back of your head:

“When COVID is over, will I keep the share I’ve grown, or will shoppers go back to shopping the way they used to?”

At IGA we have been looking into this question, both here in the U.S. and internationally. And with markets like IGA China running nine to ten weeks ahead of the U.S. in COVID-19 effects, we have been paying close attention to shopper behavior. Here are some findings that are really encouraging:

- In China, shoppers have returned to work and school, and on the surface the communities appear to be more “normal” than just a few weeks ago. But episodic outbreaks and conflicting information on the risks of the pandemic have sustained shopper fears. About a third of restaurants still haven’t reopened, or are only offering take out because they can’t sustain operations with so few customers.

- There has been more than just a shift in shopper behavior away from eat-out to eat-at-home. In fact, there is an underlying trend of “support local” going on in grocery and restaurants, too. The key insight: when shoppers are worried about safety—both shopping safety and food safety—they tend to worry that big national chains are less safe than local businesses. Said a different way, they trust their local partners more than they trust retailers like Walmart.

- According to international data, shoppers who switched to national chains or discounters but have returned to their local retailer are more satisfied with the quality of food they are getting for their family. That’s good news for us. Families who got used to shopping discounters or national chains have rediscovered the quality of fresh-cut meat, home-cooked meal items, real baked goods, and local brands.

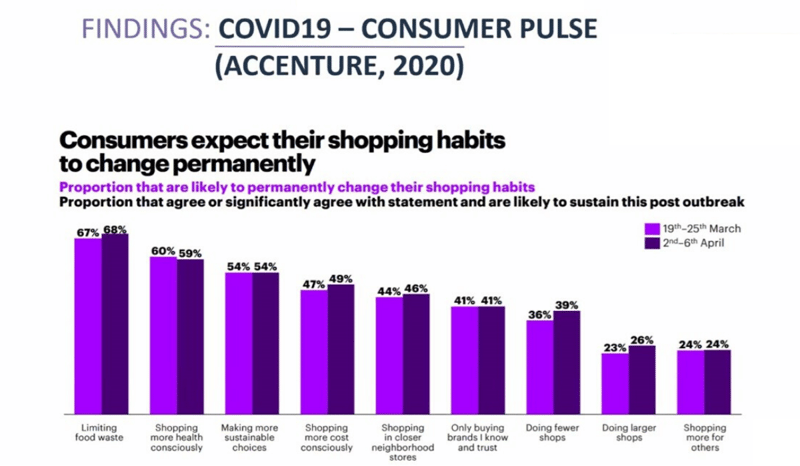

- Shopper say that they are likely to continue to shop their local retailer permanently. Look at this data from Accenture:

The data suggests we have gained two points of markets share that should continue, even after COVID-19 is just a bad memory.

Of course, this new share is ours to lose. We have to do what we do great: great quality, engaged service, fresh and healthy food. And we need to do it in a way that helps the shopper continue to feel confident in IGA as a smarter choice.

One of the biggest things we can do to take share received and convert to share owned is to ensure we have digital connections to these new shoppers. That means email, modern website, digital versions of our ads, and an eCommerce solution. Over half of net new shoppers to local say they would switch to a retailer that offered a better online solution.

Our data internationally shows that over a third of new shopper to IGA stores came through a digital connection. And those new shoppers see access to local quality through modern technology as a reason to keep IGA as a primary shopping partner.

Great news overall, and great news for our future!

Previous Story

← Eating Our Feelings: Snacking Up in COVID

You May Also Like

These Stories on From the Desk of

Jun 17, 2025 3:12:02 PM |

2 min read

May 14, 2025 1:17:39 PM |

2 min read

No Comments Yet

Let us know what you think